Receipts and payments accounts. The guidance available below explain the principles underlying receipts and payments accounts and provide advice and tips on when and how to prepare this type of accounts in accordance with the charities accounts and reports regulations northern ireland 2015.

Kids charitable groups are generally with the most used charities worldwide, alongside cancer, environmental, hospitals and our well being funds. Organizations including World Vision, Habitat for Humanity and Save a Child are a couple of the serious institutions which specifically accommodate the requirements of children universally. When donating to charity, often theres a simple percentage belonging to the donation which is often used towards administration or other costs, and 100% does not always go where expected. Although there are regulating organizations to the money is spent, some people still continue skeptical, which will keep them from donating.B Oscr Consents Notes

Three are prepared by the trustees.

Charity commission example receipts and payments accounts. This work pack can be used by all non company charities whose gross annual income is less than 250000 and where there is no requirement within the charitys constitution or by funders or the charity. Charity law does not specify any format for preparing receipts and payments accounts but they should be prepared in a consistent way from year to year. Accounting templates for non company charities with gross incomes of 250000 or less which can prepare receipts and payments accounts.

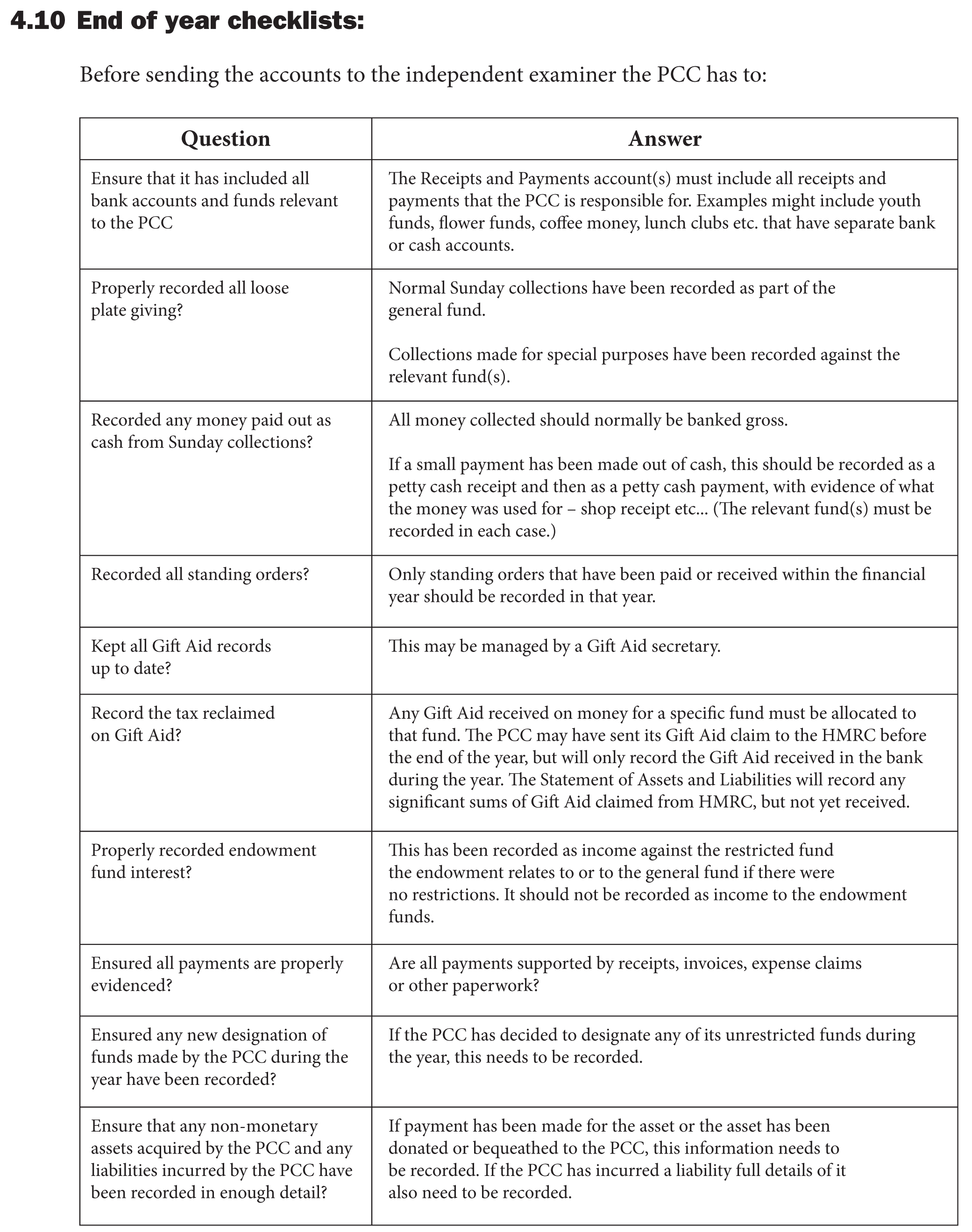

The bulleted list below is our receipts and payments work pack which includes guidance and templates. Less than 250000 a year you can choose to prepare either accruals accounts or the easier receipts and payments based accounts. This focuses on the cash movements in and out of the pccs bank accounts during the financial year.

A trustees annual report giving details about the charitys activities for the public benefit in the year. A receipts and payments account providing an analysis of. Scottish charity accounts guidance on the preparation and examination of accounts using the receipts and payments method 2 the purchase or sale of assets for cash directly by the charity rather than a broker would be included in the receipts and payments accounts.

Providing the gross income of your pcc is less than 250000 you can choose a simpler form of accounting the receipts and payments basis. Accounting templates pdf and ms excel for non company charities with gross income of 250000 or less which can prepare receipts and payments accounts. Charity commission guidance on accounting and reporting email.

Receipts and payments accounts will usually consist of four related documents. A separate guide is available for. The toolkit and example accounts also below have been finalised and are a key component of the commissions receipts and.

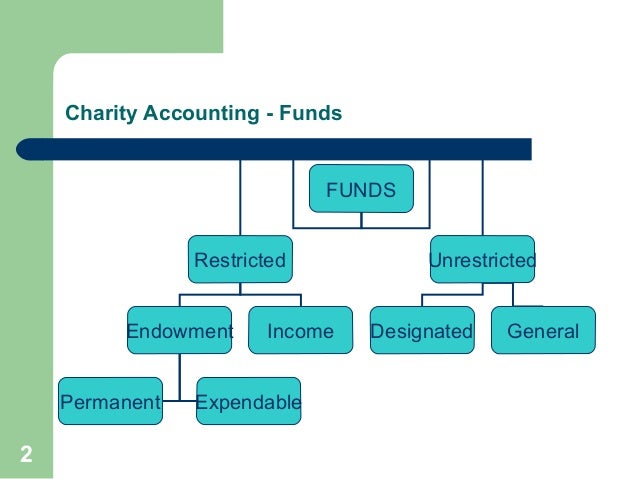

Receipts and payments accounts charity name charity number if any for the period from start date d m yto end date section a receipts and payments a1 receipts unrestricted funds to the nearest restricted funds to the nearest endowment funds to the nearest total funds to the nearest last year to the nearest sub total a2 asset. Any payments have been made or costs deducted but excluding any capital received for endowment. Over 250000 a year you must report using accruals accounts.

Receipts and payments accounts work pack. We have produced a pro forma for this report. If you present receipts and payments accounts you must also provide a statement listing assets and liabilities at the end of the year.

Receipt And Payment Account Characteristics Preparation Examples Etc

Acknowledgement Of Letter Received Template Receipt Payment Example

The Independent Examination Of Receipts Payments Accounts

Chapter 4 The Church Of England

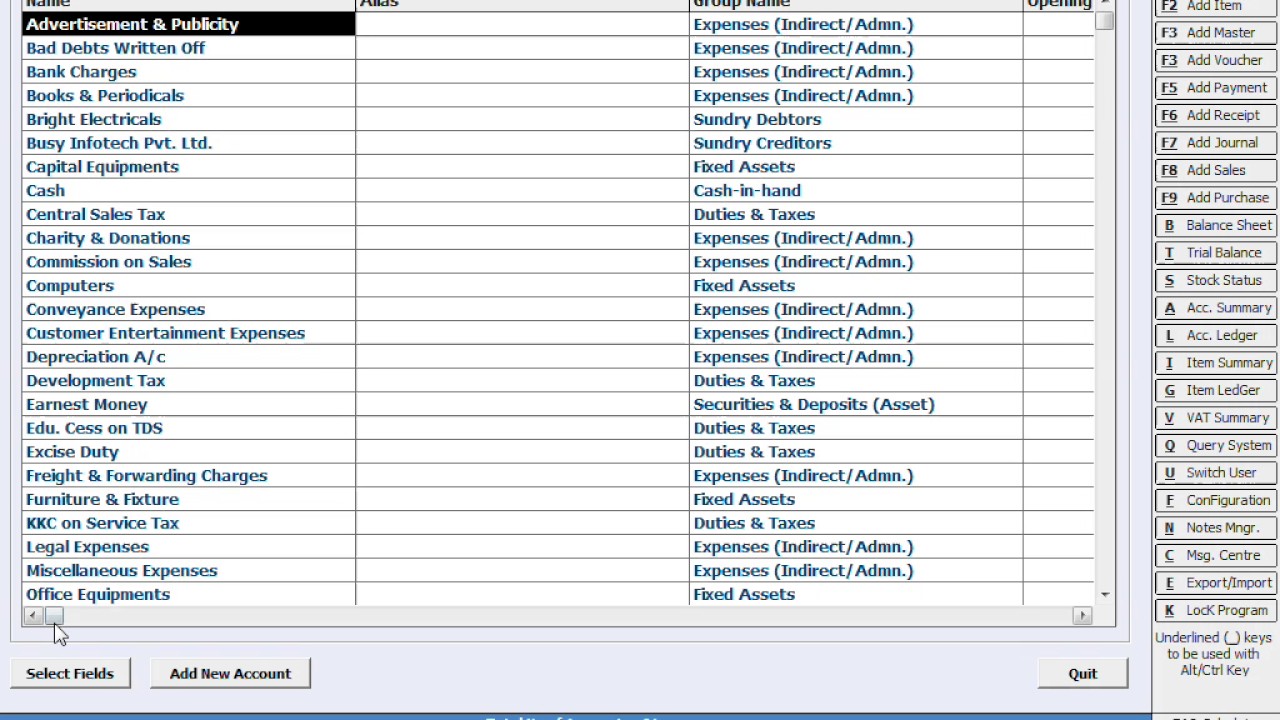

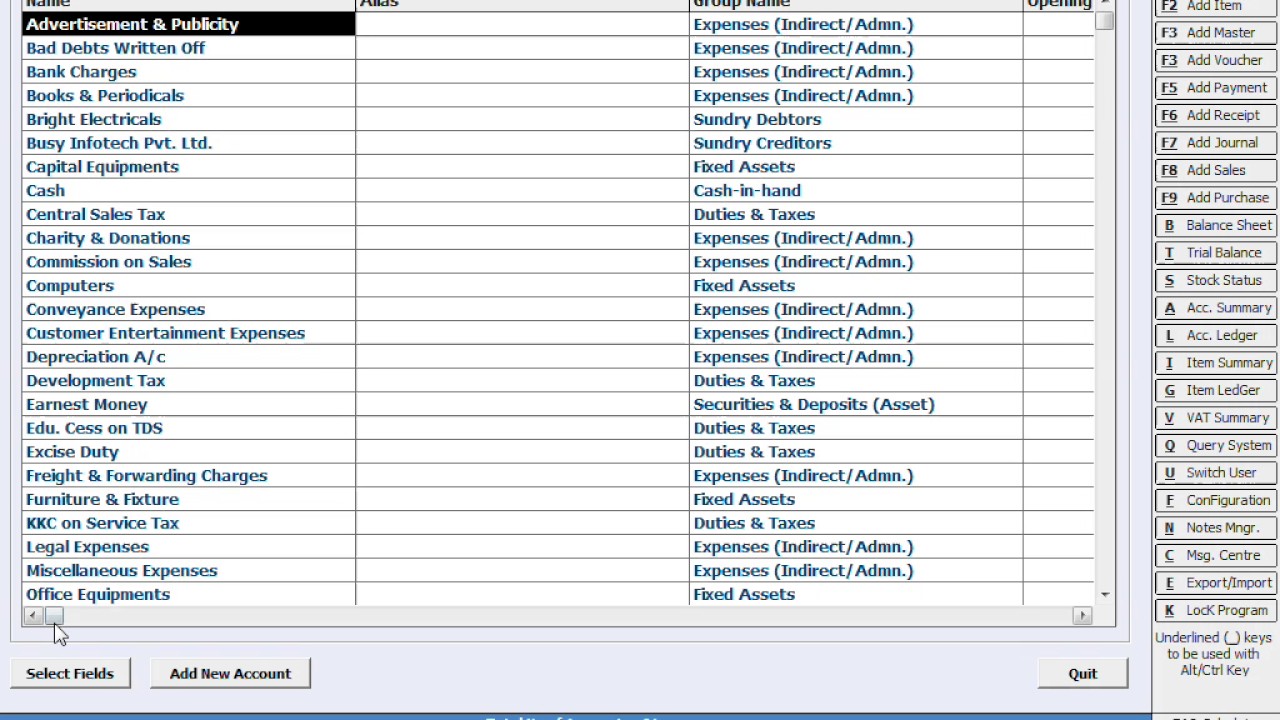

Lesson 12 Creating Master Account And Item In Busy Youtube

0 comments:

Post a Comment